Lagos News

Get the latest Lagos news today on politics, business, and city stories. BestLagos keeps you updated with breaking updates across the state.

How the 2026 Tax Act Affects Lagos Professionals and Business Owners

With the official implementation of the Nigeria Tax Act (NTA) 2025 this January, Lagos professionals are waking up to a...

Read moreDetailsAkpabio Backs One State Creation, Says It’s Nigeria’s Only Demand-Driven Proposal

Senate President Godswill Akpabio has thrown his weight behind the creation of Ibadan State, describing it as the only state...

Read moreDetailsNight of Glamour, Music and Luxury as Wellborn Hotel Unveils The Pergola Rooftop Lounge

All roads led to Wellborn Hotel on Sunday, December 21, as Lagos’ social, entertainment, and business elites gathered for the...

Read moreDetailsHow Lagos Police Uncovered ₦2.5m Kidnap Scam by South African Resident’s Wife

LAGOS – The Lagos State Police Command has arrested 26-year-old Misturah Bada and her accomplice, Adedamola Daniel, for allegedly staging...

Read moreDetailsPastor Chris Okafor Responds to Bedroom Photo Leak with Class, as Doris Ogala Hints at More Revelations

The drama surrounding Pastor Chris Okafor took a new turn when actress Doris Ogala shared an alleged bedroom photo of...

Read moreDetailsLagos Traffic Alert: Road Closures for Autofest 2025

The Lagos State Government has issued a traffic advisory ahead of the 7th Road Edition of the Lagos Autofest 2025...

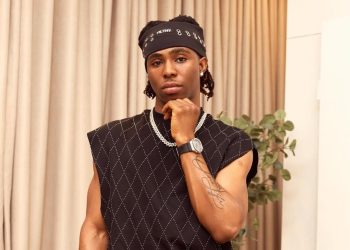

Read moreDetailsFola Apologizes After Chaos at Lagos Concert

Afrobeats star Fola has issued a public apology after his first headline concert in Lagos ended abruptly due to safety...

Read moreDetailsLagos Police Arrest Peller Over Viral Reckless Driving, Suicide Attempt

The Lagos State Police Command has arrested and detained Habeeb Hamzat, 20, also known as 'PELLER', following a widely shared...

Read moreDetailsFola’s Lagos Concert Turns into Major Flop: Fans Rage Over Tiny Venue

Fola's first headline concert in Lagos drew big crowds but left many fans unhappy. The event took place on December...

Read moreDetailsTikToker Peller Hospitalised After Suicide Attempt Following Breakup With Girlfriend Jarvis [VIDEO]

Popular Nigerian TikToker and streamer, Habeeb Hamzat, widely known as Peller, has been rushed to the hospital following a self-harm...

Read moreDetailsTGIF in Detty December: 7 Lagos Nightclubs You Must Hit This Festive Weekend

It’s that time of the year again, Detty December, when Lagos fully transforms into Africa’s undefeated capital of nightlife. From...

Read moreDetailsTerrifying Uber Ride: Lady Panics After Discovering Broken Door Lock Mid-Trip [VIDEO]

A Nigerian lady has sparked conversation online after recounting a frightening experience during an Uber ride. The incident, which quickly...

Read moreDetailsFamily of Three Killed in Otedola Bridge Crash, Truck Driver Flees

A tragic multi-vehicle collision early this morning at the Secretariat inward Otedola Bridge on the Lagos–Ibadan Expressway has claimed the...

Read moreDetailsNew AGN President Abubakar Yakubu Arrested After Deadly Surulere Crash

Newly elected Actors Guild of Nigeria (AGN) President, Abubakar Yakubu, has been arrested following his involvement in a fatal car...

Read moreDetailsThird Mainland Bridge Fire: Sienna Bus Erupts in Flames

Traffic flow was disrupted on the Third Mainland Bridge this afternoon after a Sienna space bus was completely engulfed in...

Read moreDetailsWhere to Find the Best, Most Affordable Moi Moi in Ikeja: Top Spots That Never Miss

If you’re craving soft, flavorful, properly steamed Moi Moi in Ikeja, the kind that “slaps harder” than your expectations, you...

Read moreDetailsDetty December on a Budget: 15 Affordable Lagos Events You Can’t Miss This Festive Season

Detty December has become a cultural phenomenon in Nigeria; a time when Lagos transforms into a city of endless parties,...

Read moreDetailsEyo Festival 2025: Lagos Island Buzzes for December 27th Celebration

Lagos Island is already buzzing with anticipation as the iconic Eyo Festival prepares for its grand return on December 27,...

Read moreDetailsLekki-Epe Transport Corridor Restructuring Begins

The Lagos State Government is decisively restructuring the chaotic Lekki–Epe Corridor transportation system, replacing unregulated movements of Danfo and Korope...

Read moreDetailsSanwo-Olu Inaugurates TY Logistics Park FZE in Alaro City

Lagos State Governor Babajide Sanwo-Olu officially launched the TY Logistics Park Free Zone Enterprise (FZE) in Alaro City yesterday, December...

Read moreDetailsLASU Condemns ‘Bandits Prank’ Video That Caused Campus Panic

The management of Lagos State University (LASU) has strongly condemned and distanced itself from a viral video titled "Bandits Prank...

Read moreDetails6 Costly Mistakes to Avoid When House-Hunting in Lagos And How to Protect Your Money

House hunting in Lagos is not for the faint-hearted. The process can be confusing, overwhelming, and filled with traps that...

Read moreDetailsLoaded Truck Fire Causes Massive Gridlock on Ikorodu Road

A loaded truck carrying drinks caught fire on the Odoyalaro Bridge this morning, causing severe traffic congestion for commuters heading...

Read moreDetailsTwo Killed in Tragic Overnight Crash on Otedola Bridge

A tragic accident occurred overnight on the Otedola Bridge, inward Berger, resulting in the instantaneous death of two car occupants....

Read moreDetailsStuck Again? 5 Brutal Ways Lagos Traffic Destroys Your Week – and Smart Hacks to Beat It”

If you live in Lagos, you already know that traffic isn’t just an inconvenience, it’s a full-blown lifestyle hazard. From...

Read moreDetailsLexus Jeep and Pickup Collide on Apapa-Oshodi Expressway

An early morning road accident on the Apapa-Oshodi Expressway near Anthony Oke, heading towards Gbagada, has been reported with injuries....

Read moreDetailsThird Mainland Bridge Gridlock: Tanker and Truck Accident Causes Major Delays

An overnight accident involving a tanker and a truck on the Third Mainland Bridge has resulted in significant traffic congestion...

Read moreDetailsBolt Price Hike Hits Lagos Riders Hard This December – Driver Shares Simple Hack to Save Money

Lagos residents who use Bolt for rides face higher prices this December. The ride-hailing app raises fares because more people...

Read moreDetailsSanwo-Olu Unveils ₦4.237 Trillion ‘Budget of Shared Prosperity’ for 2026

Lagos, Nigeria – Governor Babajide Sanwo-Olu has officially presented the 2026 budget proposal to the Lagos State House of Assembly,...

Read moreDetailsOffset Reportedly Rejects $10M Divorce Deal, Demands Half of Cardi B’s Fortune

The messy split between hip-hop power couple Cardi B and Offset has taken a dramatic turn as new reports claim...

Read moreDetails