From the ancient method of digging pits and carving holes in roofs to bury wealth, finance management has come a very long way to this present age where money is kept in banks for a variety of purposes including safekeeping, saving, and easy transfer across various sources.

Kuda

Various banks have risen in Nigeria and various banks have also been washed away over time. Kuda Microfinance Bank (Kuda MFB), also known as Kuda Technologies, is an online banking platform initially formed in 2017 as Kudi Bank but later changed to Kuda in 2019 after getting licensed by the Central Bank of Nigeria (CBN). The bank has slowly gained in popularity and users since then.

History

Kuda MFB was founded by Babs Ogundeyi and Musty Mustapha in 2019. It was initially called Kudi Money and ‘the bank of the free’.

Kuda has amassed a lot of income and success in its 5 years of functioning. It was initially meant to be a savings and lending-only bank, however, following the increase in demand, Kuda had to change and upgrade its processes into that of a neobank.

A neobank is a bank which focuses mainly on online transactions. After the upgrade, Kuda’s popularity skyrocketed until it became the number one neobank in Nigeria. Kuda has an estimated value of about five hundred million dollars.

The bank has generated income of about ninety million dollars from various investors worldwide. Kuda Bank is not limited only to Africa as it has some dealings with the United Kingdom (its headquarters is located in London).

Users and Social Presence

As a neobank, Kuda MFB has about sixty million users, effectively generating an income of about ninety million dollars. The bank has about two hundred thousand followers on its Instagram and X accounts.

Kuda Awards

Kuda has won some awards since it started functioning as a neobank. 2022 and 2023 were great years in the history of Kuda’s success as these years had more users downloading the app and making use of the bank’s service.

Along with the sixty million users mark, Kuda Bank also won various awards in 2022 and 2023 as one of the best banking platforms in Nigeria including the GAGE Innovative Bank of the Year Award, Vanguard Fintech Company of the Year Award along with the more recent 2023 Africa Fintech Summit (AFTS) Excellence In Fintech award presented by the Africa Fintech Summit (AFS) in Washington, DC.

CEO of Kuda Technologies Babs Ogundeyi has expressed his excitement at the rapid growth and development of his neobank as well as his contentment in being able to meet the needs of the public. Following its success in Nigeria, Kuda MFB has started spreading its roots to the United Kingdom and hopes to extend its area of influence to every corner of Africa.

Kuda Bank Location in Lagos

Kuda as a neobank does not have a lot of branches. However in a big city like Lagos, it has a branch at 151 Herbert Macaulay Way, Yaba, Lagos State, this branch serves as the main hub of Kuda Bank in Nigeria.

Crisis Faced

In its five years of service, Kuda has faced some crises which the company overcame to get to where it is now. Some of this crisis includes the six billion naira loss incurred by the bank in 2021. This loss was due to defaulted loans, rising personnel costs, and the price of advertising. When converted to dollars, the loss reached about fourteen million dollars. Kuda also experienced a lot of glitches and technical difficulties.

These technical difficulties still occur once in a while. One major technical issue that happened in the early months of 2023 caused all Kuda Users to read zero in their account balance regardless of the amount which was there before. This caused a lot of concern and unrest amongst users of the neobank as the matter made people fear that the bank had gone down along with their money.

Reviews

Kuda has garnered a lot of reviews, both good and bad from their users. It won’t be easy to find out if the ratio of good reviews surpasses the bad reviews or whether the reverse is the case as they can be considered equal.

While there are a lot of complaints about glitches, technical problems and lagging on the app, users can’t help to commend the features of the bank especially the charge-free feature which allows users to transfer and pay bills without charge. Notably, during the times when the system is smooth, Kuda can be said to be one of the fastest neobanks in the whole of Africa.

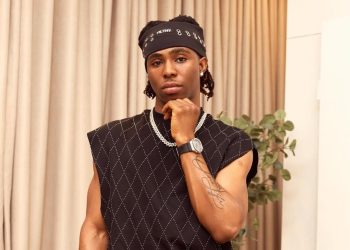

Babs Ogundeyi (Kuda Bank CEO and Co-founder)

Babs Ogundeyi is the CEO and Co-founder of Kuda Bank. He’s around forty years old, an indigene of Oyo state, and has a net worth of about fifty million dollars. As the CEO of Kuda MFB, one of his main goals is to make banking more accessible and affordable. To some extent, he has succeeded in this plan.

One of the major factors that helped Babs Ogundeyi succeed in creating his bank is the fact that he was the Special Adviser on Finance to the Governor of Oyo State in Nigeria, Babs used his considerable private sector knowledge to ensure the steady growth of Kuda Technologies. He has some connections to the United Kingdom as he attended Brunel University London. He also attended the Down’s School and King’s College Taunton.

Due to his ties to the United Kingdom, Babs Ogundeyi has stretched the arms of Kuda Technologies to London. The neobank has made available an option to create a Great Britain Pound account for citizens of the United Kingdom.

Conclusion

Kuda Microfinance Bank has braved a lot of storms to arrive at where they are right now. Babs Ogundeyi must feel very proud of how far he has come. Most likely he is still planning more features and upgrades which would make the name of the bank resound more in the future. Do you have any questions about Kuda Technologies? Let us know in the comment section below.